How A Realtor Can Help you Buy a Home with Crypto.

Finding your dream home or selling your property is fraught with complexities. I offer expertise, ensuring that your path is as smooth as possible. With a commitment to personalized service, I don’t just facilitate transactions; I craft experiences. The modern real estate landscape demands more than just a mediator; it requires a visionary who understands the intricate dance between market trends and personal aspirations. I embody this role, leveraging my deep knowledge to serve your best interests. Feel free to contact me at 858-330-1242.

Berkshire Hathaway HomeServices California Properties brings the weight of a respected brand to your real estate endeavors. This partnership promises not just excellence but a legacy of trust and unparalleled service.

California Title is a Title Company. (Also Affiliated with Berkshire Hathaway HomeServices) Here is a link A title company.

Contact me [email protected], Mike’s Digital Business Card or 858-330-1242

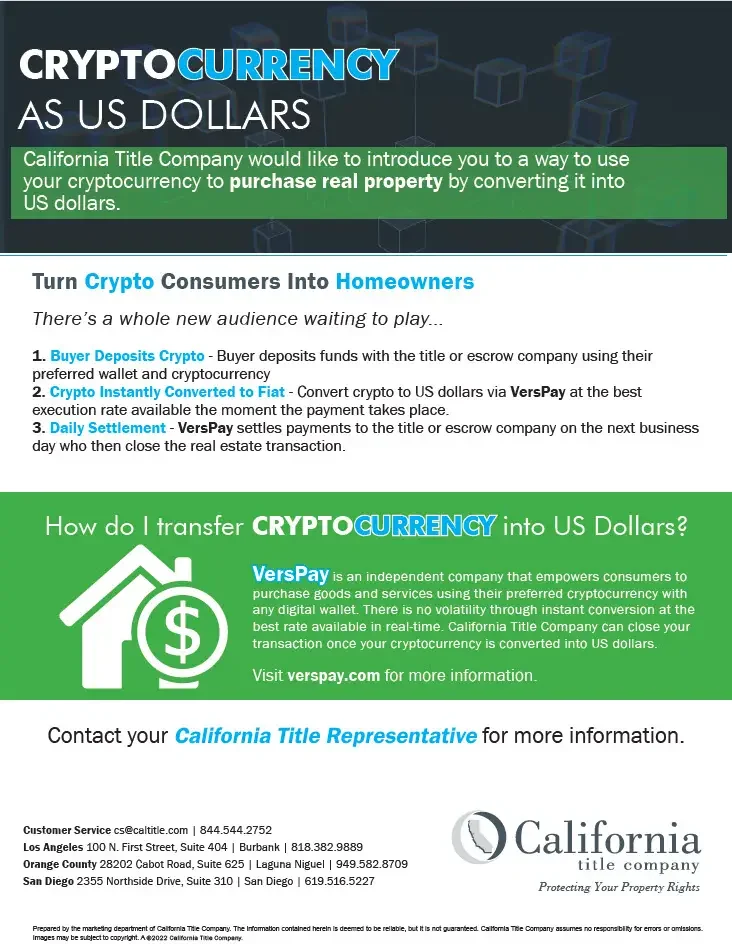

Purchasing Real Estate with Crypto?

Mike Frey (Realtor) Berkshire Hathaway HomeServices California Properties and California Title are not a replacement for your CPA. You should consult your CPA to ensure you don’t have to withhold capital gains/losses from your Crypto position.

Convert to US Dollars? VERSPAY

You need to sell and convert your cryptos into US Dollars first. You cannot pay directly with crypto; it needs to be converted to US dollars. Why? All the vendors involved in buying and selling houses do not accept crypto as payment. Personally, I prefer US Dollars for my commissions; if I decide to buy crypto, it’s my personal choice and not part of any contract. I will pick my entry point, thank you. 🙂

Quick Questions Answered

FAQs

- Question: Can I buy any property in San Diego with cryptocurrency through VersPay?

Answer: Yes, with California Title and VersPay, you can purchase any property listed in San Diego. Mike Frey Realtor can help find your home as soon as I receive your pre-approval from you bank. - Question: How do you convert cryptocurrency to USD for transactions?

Answer: VersPay uses a straightforward and secure conversion process, offering competitive exchange rates. They ensure the conversion reflects the real-time value of your cryptocurrency, making the transaction transparent and fair. - Question: Are there any additional fees for buying a home with cryptocurrency?

Answer: Typical Closing Fees,(~2-3%) First Down Payment (3%), Agent Concession (Negatable, and may be stacked on the loan) along with all cash offer or mortgage paperwork. We aim to minimize additional costs, ensuring you get the best deal for your real estate investment. - Question: How long does the buying process take when using cryptocurrency?

Answer: The timeline can vary based on several factors, including the speed of the conversion process and the details of the real estate transaction. However, we strive to make the process as fast and efficient as possible. We recommend talking to your CPA first. There may be withholdings necessary before you purchase your new home, or capital gains/losses that you and your CPA will need to talk to you about. - Question: Can I consult with Mike Frey before deciding on a property?

Answer: Absolutely! I will add more value to your purchase than the cost of concessions. You will need to sign a Buyer Agreement before we look for homes. This way I can explain the commissions and the value I add. - Stay up to date with Real Estate. Check out my Blog.

Call me, Mike Frey your Realtor, for more information if you’re considering taking money off the “Cryptocurrency Table” and Investing in Real Estate. I can help you with this task. Mike Frey 858-330-1242

Here is my WhatsApp link and Digital Business Card or 858-330-1242

Want to learn about 1031 Exchanges?

Deciding what to buy, when to sell, and how long to hold—it’s always difficult. (IF you didn’t have a goal price, then how would you know when to sell?)

I can’t make that call for you, but there’s one thing I can tell you: you won’t accumulate any life-changing wealth if you don’t take profits and reduce your exposed to risk.

Eventually, that risk is going to catch up, and you could lose everything. My advice? If you’re up on your crypto investments and considering cashing out, think about putting some of that money into real estate. It’s a solid way to reduce your risk and still keep your capital working for you.

Check out my Real Scout page or my New Homes Page for San Diego Real Estate.

Find out how much a San Diego Home is?

I set up a special Home Search page for you to get a local view of properties to see in San Diego. Featuring TWO amazing search platforms for you, absolutely free. Real Scout and Berkshire Hathaway Home Search website and App. Click Here.

Contact: [email protected] or call 858-330-1242 (Feel free to call me. Let’s talk about real estate.)