Homeowners Insurance Help for San Diego

I compiled this page to help homeowners navigate San Diego’s newest problem. Homeowners Insurance! or Home Insurance (Including Very High Severity Fire Zones. Now, most of San Diego County)

Mike Frey REALTOR® Contact Page | Phone: 858-330-1242 / Email: [email protected] / V-card

Homeowners Insurance:

The recent Los Angeles fires (2025) have highlighted the growing challenges surrounding home insurance premiums. To assist homeowners in San Diego, navigating this topic may not be on top of mind. (That is the point)

I am compiling (and continually updating) a list of reliable insurance agents who can help you find the best solutions for your home insurance needs.

Note: If you are a fire victim, my top priority recommendation is to keep paying your mortgage premiums. (As painful as it sounds) Staying in good standing with your lender is crucial, as it may improve your chances of qualifying for a mortgage adjustment if needed. Remember to document everything carefully.

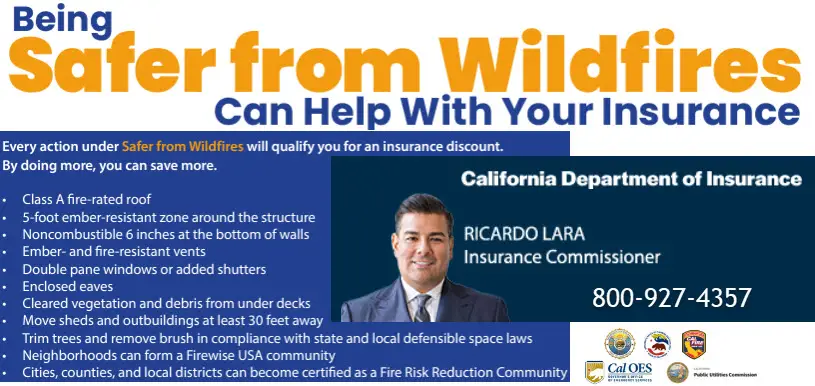

How to Fire Harden you Home in San Diego. https://readyforwildfire.org/

Law of Price Gouging during the time of disaster.

Under California law, CA Penal Code section 396(e), businesses and landlords are limited to price increases capped at 10% in a state of emergency. This may be extended due to the LA Fires (2025)

Map of Very High Severity Fire Zones in San Diego.

NOTE: Since I am not an Insurance Agent, and don’t sell Home Insurance. I can list my favorite San Diego Real estate agents. (In No Particular Order) HomeServices Insurance is an Affiliate of Berkshire Hathaway HomeServices. The company I work at.

Insurance Agents Who YOU Should Call..

Homeowners Insurance In San Diego!

Make your first call to Matthew Rosenberg, Insurance Agent. San Diego

Phone Number: (619) 795-1388

Email Address: [email protected]

Pete is an Excellent Resource to get Home Insurance. (At least get a quote) for Homeowners Insurance.

Phone Number: 858-587-2116

CA License #: 0G51406

- I always want to give a choice when possible. Mathew and Pete are Outstanding Insurance Agents.

Melanie Martinez, CA License 0C00312

Lead Sales Representative

Global Retail Markets

Insurance for Auto * Home * Life * Annuites & 401K Rollovers

────────────

Comparion Insurance Agency

A Liberty Mutual Company

1615 Murray Canyon Road Suite 300

San Diego CA 92108

Office: 858-255-3963

Cell: 858-357-7269

Fax: 603-334-8782

Josh Woods, CIC, CISR

License# 0H39923

Vice President

California Southwestern Insurance Agency

License #0443354

25 Orchard, Suite 100, Lake Forest, CA 92630

———————————-

Direct: (949) 707-0471

Cell: (951) 216-5611

Fax: (949) 588-8348

———————————-

Email: [email protected]

LAUREN BOTTGER |

Founder | License #0M26835 |

Phone: 858.216.6039 | F: 858-430-2400 |

Email: [email protected] |

Address: 6119 La Granada, STE B Rancho Santa Fe, CA 92067 |

California Fair Plan.

(Is it really fair? Or does it require “Multiple” Independent Insurance Policies to be covered?)

Property Insurance. (Click Here for the link.)

The California FAIR Plan offers Dwelling policies for customers that are unable to purchase coverage with a traditional insurance company.

Link to the Department of Insurance.

Many Fire Safe Councils have successfully implemented such projects as hazardous-fuel-reduction projects, Community Wildfire Protection Planning, and homeowner training. Click Here

Defensible Space Cal Fire (Click Here)

Very High Fire Hazard Severity Zone. City of San Diego Fire 3DI Application for Real Estate Defensible Space Inspection. (AB38) Certificate Application Inspection Request. (Click Here)

Update on the California Insurance market!

- The California Insurance Market is still in upheaval. Most major carriers are still not accepting new home businesses, including State Farm, Allstate, American Family, Farmers, Travelers, (Very Limited), and Safeco. (Very Limited) These carriers are also reinspecting current home clients and possibly canceling their policies in San Diego.

- For Example, State Farm is canceling 80,000 current home policies and apartment building policies.

- Home Insurance will be #2 of the biggest deterrents when purchasing a home in San Diego. #1 will be home in a very high fire severity zone.

- If you’re thinking about selling your home in a high fire severity zone, contact me before making any repair investments.

- Mike Frey REALTOR® Contact Page | Phone: 858-330-1242 / Email: [email protected] / V-card

What does the mean?

- The Home Insurance market will remain challenging for some time. (Years, unless there is a change in the Structure of Insurance in California)

Both buyers and sellers must have a clear understanding of the situation. Buyers should know the cost of insurance before they start looking at homes, and sellers should proactively discover and disclose this information. The cost of insurance will likely differ from what the original owner paid.

If buyers receive the insurance cost after going under contract, they may choose to back out of the deal. This is a significant disadvantage for sellers, as it can result in wasted days on the market and lost momentum.

By ensuring buyers know the insurance cost before submitting an offer, sellers can reduce the likelihood of a deal falling through and increase the chances of a smooth transaction.

Mike's Recommendations.

First, if you haven’t talked to me, you should immediately.

Home Sellers:

- We will tackle this issue head-on; let me show you how. Contacting the right insurance agent can be a real “Win” for you.

- I understand the California Fair Plan, the Go-To for the remote mountain getaway, is now taking on the surplus of homes throughout California. (This insurance was NOT established to adequately cover a single-family home in San Diego.) I understand that they don’t NOT cover liability or water damage, so you will need a “Wrap Around Policy” from another carrier to get adequate insurance coverage.

- One of the Insurance Agents on my webpage can walk you through this.

Home Buyers:

- If you’re buying a home, let me educate you on what is involved with purchasing a home in San Diego. Insurance and Fire are the big issues in San Diego. (But NOT on all properties)

- I strongly advise you to take the initiative and reach out to your trusted insurance agent before embarking on your home search. This step will empower you with the necessary knowledge and control over your home-buying process.

- I have a strategy for getting the best price on a property, pointing out the home’s insurability coverage limitations. (Recent changes in the Law make this a hot topic)

General Comments from Mike:

- What is a “Safe Bet” for an Insurance Company in California? (What do they want in a House to cover) Properties NOT in a High Fire Zone, New Roof, Electrical within the last 12 years. Vegetation size and tree proximity. They don’t like established houses (Older Wiring, Some Electrical Boxes and Roofing). That is not good for San Diego Home Buyers. To solve this issue, you should work with me to get the best deal possible.

Mike Frey REALTOR® Contact Page | Phone: 858-330-1242 / Email: [email protected] / V-card

Mike Frey REALTOR® Contact Page | Phone: 858-330-1242 / Email: [email protected] / V-card

Pages

- Senior Downsizing Services | Simplify Your Move San Diego

- Selling a Trust Home: A Guide for San Diego Owners

- San Diego’s New Buyer Agreement Explained

- Blog

- Post Sale, Essential Tips for New Homeowners in San Diego

- Affordable Houses In San Diego!

- New Homes for Sale in San Diego | Find Your Dream Home

- San Diego Realtor | 1031 Exchange Expertise

- Contact Mike Frey Realtor

- Moving And Services

- San Diego Market Report | Latest Trends & Insights

- Home Insurance Help | Protect Your San Diego Home

- San Diego Income Properties & Short-Term Rentals

- Can You Buy A House With Crypto Currency?

- Home Selling: Step-by-Step Checklist

- Buy Before You Sell | Pinnacle & Guaranteed Offer

- San Diego Real Estate Pricing

- RealScout: Smarter Home Search in San Diego

- Zillow Showcase, Listing Agent in San Diego

- San Diego Buyer’s Agent | Expert Homebuyer Support

- luxury homes for sale in La Jolla

- Sell Your San Diego Home | Expert Guidance & Strategies

- About Mike Frey Realtor in San Diego

- Privacy Policy

Buying a home in San Diego with a low down payment?

San Diego Realtor Mike Frey | Phone: 858-330-1242 / Email: [email protected] / V-card Berkshire Hathaway HomeServices National Website However, it comes with some considerations, especially given the high market prices in

Don’t Sell Your San Diego Real Estate.

Don’t Sell Real Estate Unless You Have To. Think Pinnacle? Selling real estate is one of the biggest financial decisions a homeowner or investor can